The Founder's Compass: Understanding the Pitch

Introduction

At The Founder’s Compass, we are not just writers—we’re founders ourselves, navigating the challenging yet exhilarating world of startups. Our mission is to provide a roadmap for early-stage entrepreneurs, sharing the lessons we’ve learned from building, pitching, and scaling ventures. Through this blog, we aim to empower fellow founders with actionable insights, practical advice, and an honest glimpse into the realities of entrepreneurship.

One of the most pivotal moments in a founder’s journey is delivering the perfect pitch. It’s the moment where vision meets opportunity, and a compelling pitch can capture investors’ attention, validate your startup’s potential, and unlock critical funding. But success requires more than a great idea and a dose of charisma. Crafting and analyzing a pitch involves a systematic approach to addressing key elements that signal your venture’s potential for growth and sustainability.

We created The Founder’s Compass to document our own entrepreneurial journey while equipping others with the tools they need to succeed. Today, we’re diving into the art and science of pitching, offering insights that will help founders refine their narratives, highlight their strengths, and understand what investors are really looking for. Whether you’re preparing for your first pitch or seeking to perfect your next one, this guide is here to steer you toward success.

Start with a Compelling Problem Statement

Investors want to back solutions to significant, tangible problems. Your pitch should answer two key questions:

- Is this a “must-solve” problem?

- How urgent and frequent is this issue for the target audience?

Tip: Use the “Hair on Fire” framework:

- High urgency: Immediate problems needing quick fixes.

- Persistent issues: Long-standing challenges demanding innovation.

- Future-facing opportunities: Problems that anticipate emerging trends.

Our Example:

Mobility impairment affects millions of individuals, limiting their independence and quality of life. Existing solutions often rely on invasive procedures, high-voltage devices, or complex systems that are costly, uncomfortable, or inaccessible. The lack of a reliable, non-invasive alternative is a persistent issue, leaving many in the mobility-impaired community underserved.

Highlight a Differentiated Solution

When pitching to investors, your solution must not only address a critical problem but also stand out as an innovative, compelling alternative to existing options. Investors evaluate two key aspects:

- Does this solve the problem in a novel and effective way?

- Is there a clear improvement over current solutions available in the market?

Common Pitfall: Many founders fail to showcase their progress, especially when a product is still in its early stages. A lack of visuals, product demos, or clear metrics can signal to investors that the solution remains unvalidated. Even basic prototypes, user testimonials, or early metrics can demonstrate traction and build confidence.

Tip: To stand out, highlight tangible progress with key performance indicators (KPIs) like early adopter feedback, user retention, or pilot results. Showcase how your solution is already making a difference and how it aligns with market needs.

Our Example:

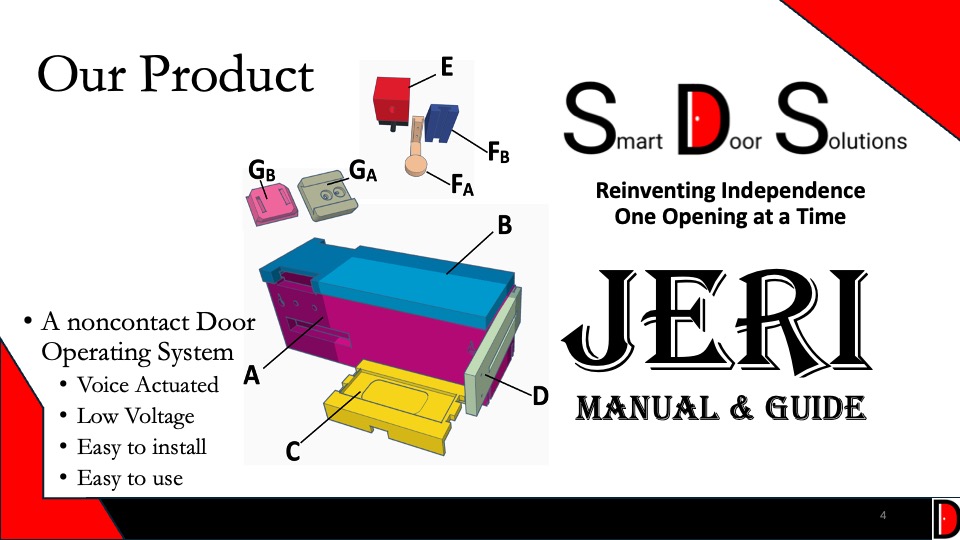

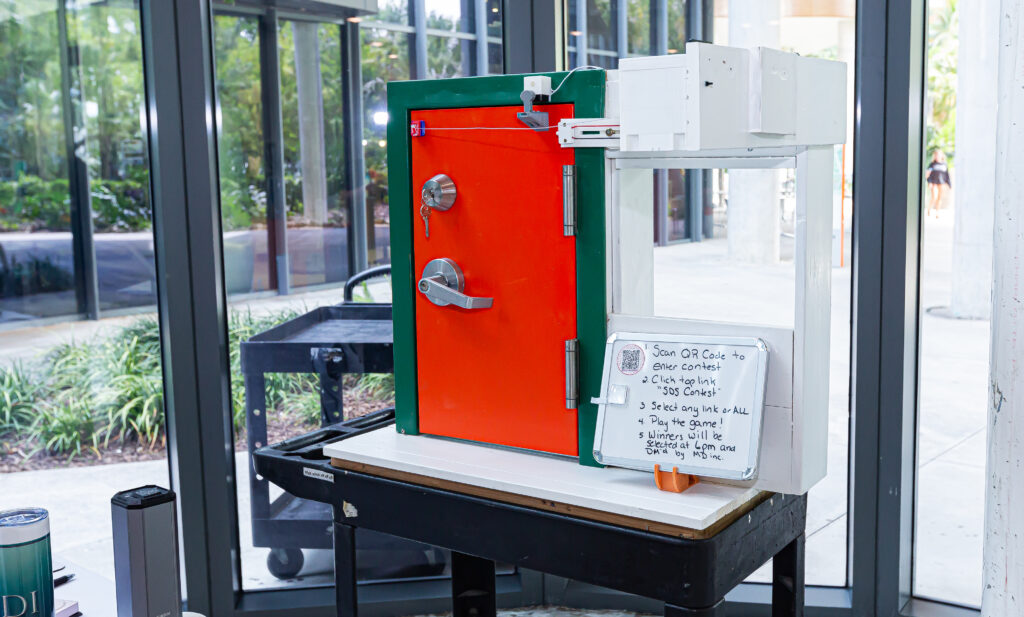

At Smart Door Solutions, our breakthrough solution, JERI, revolutionizes mobility assistance. JERI is the first-of-its-kind low-voltage, non-contact system specifically engineered to empower individuals with mobility impairments. By eliminating the discomfort, complexity, and high energy consumption of traditional devices, JERI is setting a new standard in the industry.

- How JERI Stands Out:

- Non-contact innovation: Unlike invasive alternatives, JERI utilizes state-of-the-art non-contact technology to improve comfort and ease of use.

- Low-voltage safety: Many existing devices rely on high-voltage systems, increasing costs and risk. JERI’s low-voltage design ensures both efficiency and accessibility.

- User-centric approach: JERI is lightweight, user-friendly, and designed to integrate seamlessly into daily life.

Demonstrating Traction:

Early adopters have already provided encouraging feedback on JERI’s impact, emphasizing its potential to transform lives. For example:

- Pilot Program Metrics: Initial trials showed a 40% improvement in user independence and satisfaction.

- Adoption Rates: 85% of participants expressed strong interest in continued use and willingness to recommend JERI.

- Retention Indicators: Users reported a high degree of comfort and ease, reducing the typical abandonment rate seen with traditional mobility aids.

Looking Forward:

Our roadmap includes scaling JERI’s accessibility to a broader audience through partnerships with healthcare providers, rehabilitation centers, and mobility-focused organizations. These initiatives aim to bring life-changing solutions to those who need them most.

By addressing a persistent, underserved problem with an innovative and impactful solution, JERI stands poised to redefine mobility assistance and capture a significant share of a growing market.

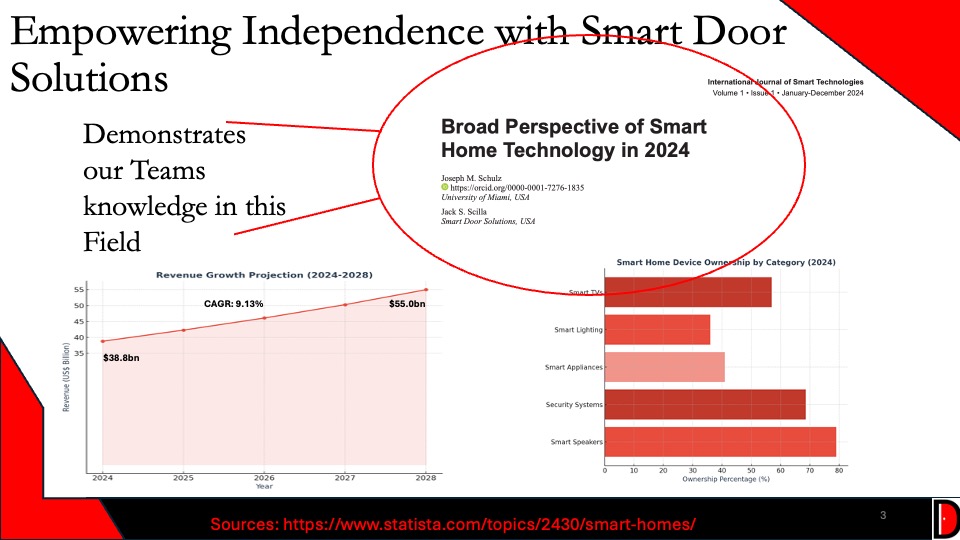

Quantify the Market Opportunity

A brilliant idea needs a viable market. Investors assess the size and scope of the opportunity using frameworks like:

- TAM (Total Addressable Market): The full revenue potential of the market.

- SAM (Serviceable Available Market): A more realistic segment you can target.

- SOM (Serviceable Obtainable Market): What portion of the market you can feasibly capture.

Example: For a fitness app:

- TAM: $20B global market

- SAM: $5B in North America

- SOM: $500M focused on urban millennials

Tip: Be prepared to explain how these figures were calculated and how trends support your projections.

Showcase a Sustainable Business Model

Investors care about how you’ll make money. A sustainable business model balances scalability with profitability.

Key Metrics to Know:

- Customer Acquisition Cost (CAC): Is it reasonable and aligned with your growth stage?

- Lifetime Value (LTV): Does it reflect strong retention and upselling potential?

- Burn Rate and Runway: Demonstrate cost control and efficiency.

Example: “Our CAC is $25 per customer, and each generates $100 in lifetime value. With a $50,000 burn rate, we have a 12-month runway.”

Build Confidence in Your Team

A startup’s potential is intrinsically linked to its founders and the team behind it. Investors recognize that even the best ideas require skilled execution, adaptability, and strong leadership to succeed. A well-rounded team not only builds confidence but also demonstrates the startup’s ability to overcome challenges and scale effectively.

What Investors Look For in a Team:

Skills Aligned with the Vision:

- Does the team have the technical expertise and industry knowledge needed to execute the startup’s vision?

- Are team members experienced in the specific challenges of the venture’s market?

Adaptability and Resilience:

- How has the team responded to setbacks?

- Are there examples of creative problem-solving or pivoting to address unforeseen challenges?

Clear Leadership and Defined Roles:

- Does the team have a strong leader who can inspire and guide?

- Are roles clearly defined to ensure that all aspects of the business—from product development to marketing—are adequately managed?

Tip: Showcase Your Team’s Strengths

When pitching, it’s crucial to demonstrate how the team’s collective expertise positions the startup for success. This includes:

Highlighting Key Roles and Expertise:

- Detail the unique contributions of each founder and key team members. For example:

- Technical Lead: A seasoned engineer responsible for building the innovative core technology.

- Marketing Lead: An experienced growth marketer with a track record of scaling early-stage startups.

- Operational Lead: A logistics expert ensuring efficiency and scalability in production or delivery.

- Detail the unique contributions of each founder and key team members. For example:

Showcasing Domain Expertise:

- Explain how the team’s background aligns with the problem being addressed.

- Example: A healthcare-focused startup might highlight a team member with years of experience in medical devices or a founder with deep knowledge of patient needs.

Demonstrating Collaboration:

- Highlight past projects where the team successfully collaborated to achieve milestones, such as launching a prototype, securing early adopters, or pivoting to refine the solution.

Celebrating Achievements:

- Showcase accomplishments that validate the team’s capability.

- “Our technical lead has built solutions for three Fortune 500 companies.”

- “Our marketing head successfully grew a previous startup’s user base by 200% in under a year.”

- “Our founder raised $1M in pre-seed funding and scaled an MVP to 1,000 active users in six months.

- Showcase accomplishments that validate the team’s capability.

Why This Matters:

Finish with a Strong Ask and Clear Next Steps

The closing slide should reinforce your investment’s potential while clearly stating:

- Funding needs.

- How funds will be allocated to drive growth.

- Specific next steps for investor engagement.

Tip: Avoid vague calls to action. A confident, clear ask demonstrates strategic focus.

Conclusion

The startup financing process involves a complex network of players, each with distinct roles and influence. Entrepreneurs must not only understand these dynamics but also navigate them with confidence and strategy. By staying engaged, selecting the right partners, and leveraging experienced advisers, founders can lay the groundwork for successful venture funding.

Reflective Question: Which player in the financing ecosystem do you feel is most critical to your success, and how can you strengthen that relationship?